Course Program of Study

Course Program of Study (CPoS) is a federal/state requirement that only allows courses that count toward a student's program of study (your declared major) to be considered when determining federal/state financial aid eligibility. There's a lot to learn about CPoS, so we've created this page to educate Tech students on Course Program of Study and how it may affect their financial aid eligibility. Click the links below to learn more!

What to Know Check Your CPoS The Federal Repeat Rule Frequently Asked Questions

What to Know About CPoS:

Course Program of Study, or CPoS, is a federal mandate that states that for students to utilize their awarded federal and state aid to help cover their course costs, the courses they register for must count towards their Program of Study, aka a student’s declared major/degree path. Therefore, received federal and state aid will not pay towards courses that do not count towards a student’s major.

Aid that falls under the CPoS rule includes but is not entirely limited to: Federal PELL Grants, Federal Student Loans, Parent PLUS Loans, and state aid including the HOPE Scholarship. In general, institutional scholarships awarded by Tech and external scholarships are excluded from the CPoS requirement. Please read the information posted below for more information concerning CPoS and the registration requirements students must meet to use their awarded/offered federal and state aid.

-

-

Undergraduate students must register for at least six credit hours [courses that count towards their program of study] per semester to utilize their federal or state aid they have received for any given term. The exception to this rule is the Federal Pell Grant, which will post even if a student registers for less than six credit hours. Students do not have to register for 12 credit hours per semester for their aid to pay towards their costs - however, please note that a student’s federal and state aid will adjust to match their credit hour status. For example, a student who has received a Federal PELL for an aid year will receive their full semester amount if they are registered for 12 credit hours, but if a student registers for only 9 credit hours, they’ll receive a reduced amount of their PELL funds to help cover their semester costs because they are not considered full time. The HOPE Scholarship adjusts to match a student's status as well - read more on our HOPE Scholarship Eligibility page.

-

Graduates must register for at least five credit hours for their federal loans to post.

-

Barring certain exceptions, courses required for a minor are not covered by federal and state aid. This means that minor hours are not counted as credit hours in the system. For example, if a student has registered for 12 hours for Fall, but one of the 3-hour courses they registered for is a minor course, the system marks that the student is only registered for 9 credit hours, or hours that count towards their degree. The aid they receive for that semester will only pay out to cover those 9 credit hours, and not the 3-hour minor course.

-

To learn more about Course Program of Study, make sure to check out the FAQs section below!

- Click Here to Learn How to Check Your CPOS!

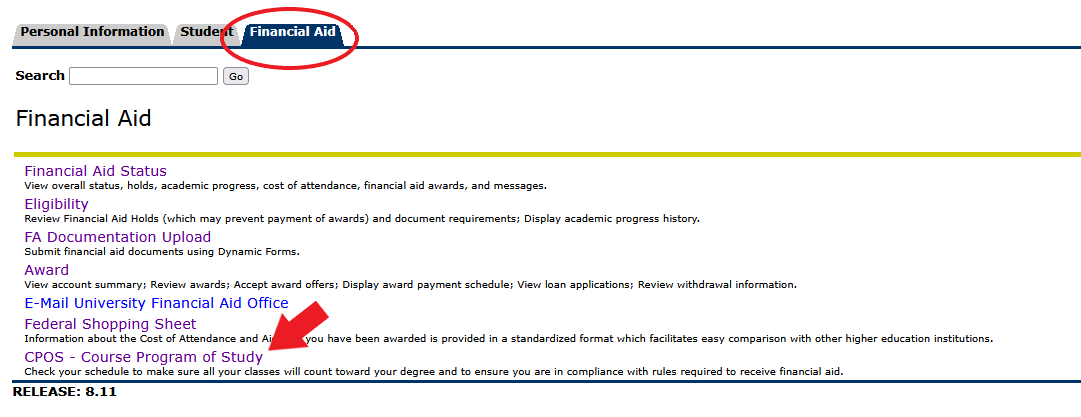

Log-in to Eagle Online and select Financial Aid - CPOS Course Program of Study

Log-in to Eagle Online and select Financial Aid - CPOS Course Program of Study

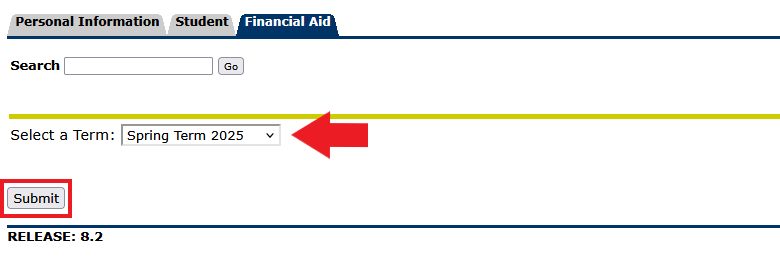

Select the correct term and click Submit

Select the correct term and click Submit

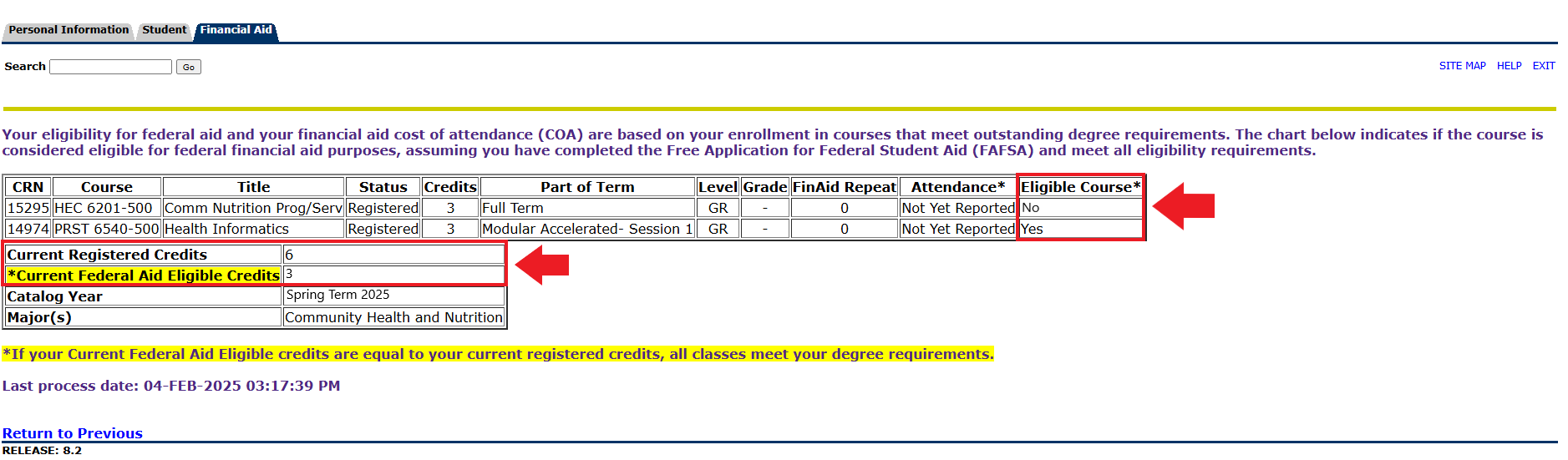

Check your courses to confirm they count towards your CPoS

Check your courses to confirm they count towards your CPoS

If you have registered for a course that does not count towards your Course Program of Study, you'll see a 'No' under The Eligible Course section in relation to that course. Additionally, the 'Current Federal Aid Eligible Credits' portion of the page will reflect that the course is not counting towards your CPoS.

If you have a course that is not counting, please make sure to contact your advisor for consultation and next steps. The Office of Financial Aid cannot change your schedule or advise you on what changes you should make to meet CPoS requirements. Only your advisor can assist you with this.

The Federal Repeat Rule & CPoS

A student's ability to use their federal and state aid to help cover courses in their program of study can be affected if a student exceeds the number of course repeat attempts allowed for federal aid.

The Federal Repeat Rule stipulates that if a student receives an 'F' grade in a course, they are permitted to retake the course with federal/state aid as many times as they need until they receive a 'D' grade or higher. Once a student receives a 'D' or higher in course, that student is only permitted to use their federal/state aid to pay for that course one additional time after that. This is regardless of what grade they receive or the grade required for progression in their major.

In short, if you received a 'D' grade in one of your courses, you are only eligible

to use your federal/state aid to cover that course ONE more time, even if the course is required for your major. After that final attempt,

and if you receive a letter grade for the course, the course will no longer count towards your CPoS in the system, and your federal/state

aid will not cover the costs of that course moving forward.

Please read the below scenarios for more information regarding the Federal Repeat Rule. If you have questions, please contact the Office of Financial Aid for assistance!

- » Scenario 1

Scenario 1: A student takes and repeats the same course as follows:

i. The first time they take the course, the student receives a 'F' grade;

ii. They repeat the course and receive a 'D' grade, however...

iii. Their major requires a ‘C’ or better, so they retake the course but make a ‘D’ grade;

iv. Student retakes the course and makes a ‘C’ grade.Answer: Because the student received an 'F' grade for their first course attempt, their second attempt was still covered by their federal/state aid. Therefore, the student received federal/state aid to cover their first three course attempts, but not their fourth because after making a 'D' on their second attempt, the student only had one more chance to take the course and have it covered by their federal/state aid. Therefore, the student's federal/state aid did not cover their fourth attempt at taking the course.

- » Scenario 2

Scenario 2: A student takes and repeats the same course as follows:

i. The first time they take the course, the student receives a 'D' grade;

ii. They repeat the course but choose to officially withdraw with a 'W' and don't receive a letter grade;

iii. The next semester they repeat the course again and receive a 'F' grade;

iv. The student repeats the course again and receives a 'C' grade.Answer: A course from which a student withdraws does not count as a repetition of a previously-passed course for determining a student's enrollment status. Therefore, the above student received federal/state funds to help cover the course for the first three course attempts, but not the fourth because, since the student withdrew from their second attempt, their third attempt now counts as their final chance to utilize federal/state aid to cover that course. Therefore, the student is not eligible to receive federal/state aid to cover the fourth attempt's costs.

- » Scenario 3

Scenario 3: A student takes and repeats the same course as follows:

i. The first time they take the course, the student receives an 'F' grade;

ii. They repeat the course but choose to officially withdraw with a 'W' and don't receive a letter grade;

iii. They repeat the course the next semester and receive a 'D' grade;

iv. The student repeats the course again and receives a 'C' grade.Answer: A course from which a student withdraws does not count as a repetition of a previously-passed course for determining a student's enrollment status. In the above scenario, the student received federal/state aid for all four attempts because the 'F' they received on their first attempt is not considered a passing grade. The student withdrew from the second attempt, so it does not count as completing or retaking the course. Since the student passed the third course attempt with a 'D', the fourth attempt counts as the student's final paid course retake. Therefore, the student can utilize their federal/state aid to cover their fourth attempt.

If you have additional questions about the Federal Repeat Rule and how it affects your aid eligibility, please contact the Office of Financial Aid for assistance!

Frequently Asked Questions (FAQs)

Below you'll find the most common questions we hear from students concerning how Course Program of Study requirements affects their aid. Simply click on the desired question for the answer!

Remember, if you have specific questions about courses in your program of study, please contact your advisor!

- » What is Course Program of Study (CPoS)?

Course Program of Study (CPoS) is a federal/state requirement that allows only courses that count toward a student's program of study (your declared major) to be considered when determining federal/state financial aid eligibility.

- » When did CPoS become a requirement?

While CPoS is not a new requirement, software enhancements became available for Tennessee Tech to begin actively monitoring CPoS during the Fall 2019 semester. All higher education institutions administering federal/state aid are required to consider CPoS.

- » Why should I be aware of CPoS?

Courses that are not eligible towards your program of study cannot be counted toward your full-time status (12 or more hours). Therefore, if you have registered for a course that does not count towards your program of study, it may affect the amount of federal/state aid you receive to cover your semester costs and could potentially lead to an adjustment in your budget for an aid year.

For example, if a student is enrolled in 12 hours but 4 of those do not count towards that declared program fo study (major), the federal/state aid that student is eligible will disburse based on the 8 credit hours that apply towards their major.

- » What type of aid does CPoS impact?

CPoS applies to federal financial aid (Federal Pell Grant, Federal SEOG Grant, Federal Direct Loans and Federal PLUS Loans) and most state aid (the HOPE Scholarships and TSAC Scholarships/Grants).

- » Does CPoS affect my Tennessee Tech awarded Scholarships and grants?

In general, institutional aid is not affected by CPoS. This means that CPoS guidelines do not change a student’s eligibility for receiving institutional aid.

Please note, however, that institutional aid is held to a student’s total Cost of Attendance, or budget, assigned each academic year. This means that on very rare occasions, a student who has received a financial aid package that meets their budget for an aid year could be impacted if they take a course that is not included in their program of study (declared major), which leads to an adjustment in their Cost of Attendance.

Example: An in-state undergraduate student who registers for 12 hours for Fall and Spring has a budget of $25,900 for the academic year. If, however, only 3 of those 12 hours count towards their program of study each term, this would reduce their total budget for the year to $21,638 due to CPoS guidelines for federal/state aid. If this takes place, it is possible that the student's institutional aid would be reduced to stay within the student's the new cost of attendance.

- » For the upcoming semester, I plan to enroll in 17 hours - 3 of those hours does not

count towards my program of study. Will financial aid pay for the ineligible 3 hour

class since I am above full-time?

As long as 12 of those 17 hours count towards your program of study (your major), you are considered a full-time student and your awarded federal/state aid will pay out in full to help pay your semester costs. So, even if 3 of your 17 registered hours do not count towards your program of study, you will still receive the full amount of your aid.

- » I want to use my federal student loan offers to help pay my costs, but only 4 of my

9 enrolled hours apply towards my current degree path. Can I still use those loans?

No. For federal student loans to pay towards your balance, you must be enrolled in at least 6 credit hours (half-time). Because only 4 of the 9 hours you have registered for count towards your program of study, you are below half-time and not considered eligible to utilize your federal student loan offers or your state aid. Students with Federal PELL Grants may still be able to receive a reduced portion of their grant below the half-time status.

- » How and when will I know if I am impacted by CPoS?

Students enrolled in courses impacted by CPoS are notified via their Tennessee Tech student email. Students will only be notified if CPoS impacts their federal/state financial aid eligibility. Please note that portions of your federal/state aid may be prorated/reduced to match your credit hour status.

- » One or more of my courses doesn’t count in my program. What should I do?

If you notice that one of your courses is not counting or receive an email from our office stating as such, contact your advisor! Remember, do not begin modifying your schedule without consulting your academic advisor first.

Once contacted, your advisor will review your account to determine whether the system is accurately assessing your enrollment. If the system is not, and your registered courses have been approved to count as part of your declared major, a course substitution request must be submitted by a designated advisor in your college/school to have the course(s) updated to count toward your federal/state financial aid eligibility in the system.

Course Program of Study (CPoS) works in conjunction with a student’s Degree Works audit. Therefore, it is important for advisors and students to refer to Degree Works. Requirements are based on the catalog year in effect when a student officially enters their program of study, aka when their major is officially declared at the time of admission to Tech or a change of major is filed with the Registrar’s Office.

- » An academic advisor has determined one or more of my courses are not required for

my program of study. What can I do?

If an academic advisor determines a course is not satisfying a requirement for your program of study (declared major), it will not count toward your federal/state financial aid eligibility. You should consult with an academic advisor to consider an appropriate course of action (adding a required course, dropping the ineligible course, or remaining enrolled in the ineligible course).

- » Can I appeal a determination that a course does not apply toward my program of study?

No. There is not an appeal process for courses that do not satisfy a requirement of a student's program of study. However, if a course has been approved as a substitution by your advisor, your Degree Works will update to officially reflect the changes once the substitution form is submitted to Tech's Registrar Office. An approved substitution allows that course to count toward your federal/state financial aid eligibility.

In some instances, certain courses may not accurately reflect in the system. These situations are reviewed on a case by case basis to make a final determination if the course is eligible in your program. If you notice a course you have registered for is not counting towards your CPoS but you believe it should, contact your advisor. Remember, do not begin modifying your schedule without consulting your advisor!

- » An advisor has submitted a course substitution form. When will my financial aid be

updated to reflect this request?

The substitution process requires action from multiple departments. Once received by the Registrar's Office, please allow 3-5 business days for your financial aid to reflect the substitution.

- » My advisor submitted a course substitution form for one of my courses that was not

counting towards my degree in the system, and the substitution was processed and my

degree path updated. When will I know if the changes 'fixed' the issue?

The CPoS automated review process runs automatically overnight and only reviews/processes updates that are reflected on your account. If the updates have been fully processed and your course is determined to be eligible, the CPoS alert/flag will clear from your account within 24 hours of the overnight CPoS process. Additionally, your financial aid will automatically update to reflect your new eligibility within 24 hours of the overnight CPoS process.

Please note, however, that a Request for Major Change is a manual process and requires additional processing time.

- » I am enrolled in courses that aren't part of my program of study but that I am interested

in. Will CPoS impact me?

Yes. If your registered courses are not satisfying a requirement for your declared major, the system will flag the courses as ineligible and they will not count toward your federal/state financial aid eligibility.

Please note that some courses may be required by both your declared major and the major you are taking classes for, and will therefore not be flagged by our system. Regardless, you should still update your officially declared major through your advisor as soon as possible, as this may cause issues later.

- » When is the last day to make major changes or modify my enrollment to potentially

impact CPoS?

The federal financial aid census, or the day your course schedule/status is locked in, is finalized on the last day to add courses for the term. This is normally the 14th day of classes after the start of a term. Your federal/state financial aid eligibility for the term is based on your locked-in schedule.

Do not wait until the last minute to submit schedule updates, as major program changes are not immediate. It is the student's responsibility to ensure their major accurately reflects their current enrollment and any updates are submitted in sufficient time to allow for processing.

- » Do electives count toward CPoS?

Possibly, if the electives satisfy a requirement for your declared major. Each degree program has variable numbers of required electives - some programs have very few, if any, electives, while others have a significant number of electives available.

If you are notified that one of your electives is not counting toward your program of study, contact your advisor. If an advisor determines that the elective is satisfying a requirement and counts toward your declared major, they will submit a substitution request to the Registrar's Office.

- » How are courses needed for completion of minors treated?

Unless a declared minor is required for your degree, federal and state aid will not cover your minor degree path. CPoS only considers a student's chosen major unless minor coursework is required for degree completion, fulfills elective credits, or meets general education requirements. Consult your advisor if you have questions regarding your minor.

- » How are courses needed for double majors treated?

Undergraduate double majors must be officially declared and reflected in Degree Works by the census date (14th calendar day of a full term for fall or spring semester) to be included as eligible coursework for federal/state financial aid.

- » How does CPoS affect study abroad?

Federal/state financial aid can help cover Study Abroad course costs if the the registered courses apply towards outstanding coursework in your officially declared program of study.